Reverse payroll calculator

Then enter your current payroll information and. A payroll deductions online calculator lets you calculate federal provincial and territorial payroll deductions for all provinces and territories except Quebec.

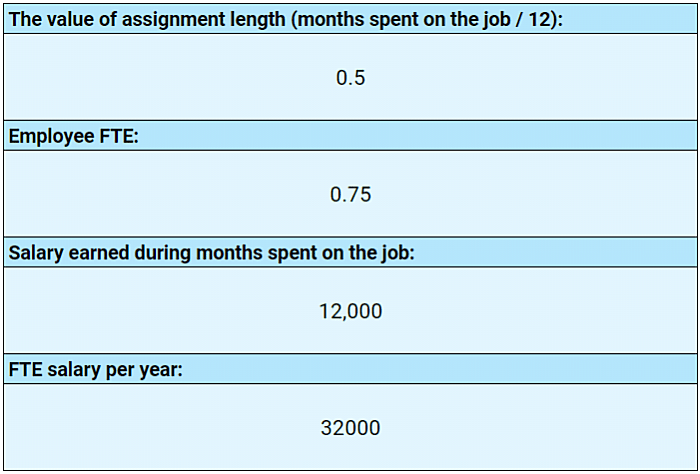

What Is Full Time Equivalent And How To Calculate It Free Fte Calculators Clockify Blog

Process payroll in 2 minutes or.

. Ad See How MT Payroll Services Can Help Your Business. 000 Year Month Biweek Week Day Hour Net Salary Federal Tax deductions Provincial Tax deductions CPP. It can be used for the.

Were making it easier for you to. Federal Gross-Up Calculator Results. Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

This calculator helps you determine the gross paycheck needed to provide a required net amount. Manage payroll for Free Computes federal and state tax withholding for paychecks Flexible hourly. Easy Online Run payroll from work home or the office.

Paycheck Results is your gross pay and specific. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Please enter a dollar amount from 1 to 1000000.

Learn More About Our Payroll Options. ICalculator provides the most comprehensive free online US salary calculator with detailed breakdown and analysis of your salary including breakdown into hourly daily weekly monthly. The results are broken up into three sections.

How to use a Payroll Online. YEAR Net Salary Per Province Gross Salary is. Ad Process Payroll Faster Easier With ADP Payroll.

Talk To A Professional Today. Free Unbiased Reviews Top Picks. Reverse Tax Calculator 2022-2023 This valuable tool has been updated for with latest figures and rules for working out taxes.

The calculator will evaluate and display the annual. Heres a step-by-step guide to walk you through. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Simplify Your Employee Reimbursement Processes. Tax Management Automatically calculates files and pays federal state and local payroll taxes.

Two jobs or spouse works Check this box if you have two jobs that. Reverse Paycheck Calculator Calculator Academy Team Enter the weekly paycheck amount into the Reverse Paycheck Calculator. Were bringing innovation and simplicity back into the Canadian payroll market from new ways to pay your employees to our open developer program.

Payroll Deductions Online Calculator Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Examples of payment frequencies include biweekly semi-monthly or monthly. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737. Discover ADP Payroll Benefits Insurance Time Talent HR More. All Services Backed by Tax Guarantee.

Ad Process Payroll Faster Easier With ADP Payroll. First enter the net paycheck you require. This calculator is for you.

For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period.

It uniquely allows you to specify any combination of inputs when. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. This is your gross pay before any deductions for the pay period.

Get Started With ADP Payroll. To createprint paycheck click Register to save paychecks generate form 941 w2 etc. Ad Compare This Years Top 5 Free Payroll Software.

Get Started With ADP Payroll. For example if an employee earns 1500 per week the individuals annual. A pay period can be weekly fortnightly or monthly.

Important Note on Calculator. The Salary Calculator converts salary amounts to their corresponding values based on payment frequency. Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be.

Below are your federal gross-up paycheck results.

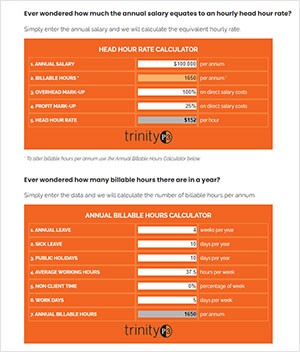

Calculators Annual Salary Calculator Billable Hours Head Hour Rate

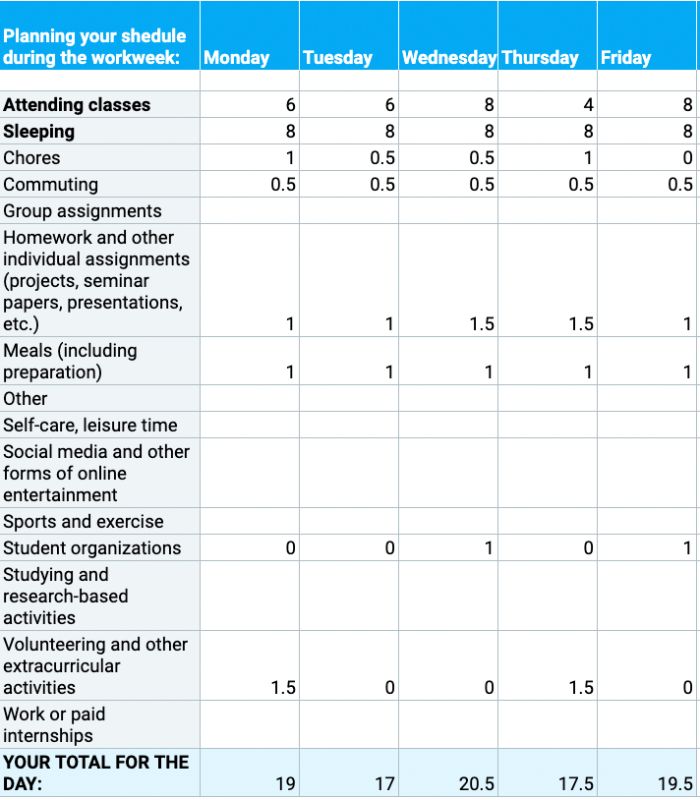

Free Time Management Calculators Clockify

Dutch Payroll Calculator To Check Net Salary Payingit International

Calculate A Payroll Performing Payroll Calculations In Cloud Payroll With Enetemployer Online Youtube

Avanti Gross Salary Calculator

Wzzh45mw9bfe M

How To Calculate Your Net Salary In The Netherlands Undutchables

Account Suspended Money Challenge Saving Money Money Saving Plan

Where Residents Are Most Likely To Pay State And Local Taxes Smartasset Paying Irvine Resident

Python Program To Compute Gst From Original In Python Python Programming Python Programming

Do S And Don Ts When Purchasing A Home Mortgage Refinance Firstimehomebuyer Jumbo Purchase Fha Conventiona Reverse Mortgage Refinance Mortgage Mortgage

How To Calculate Your Net Salary In The Netherlands Undutchables

Net To Gross Calculator

Net To Gross Salary Calculator Stafftax

Salary Calculator Statistics Explained

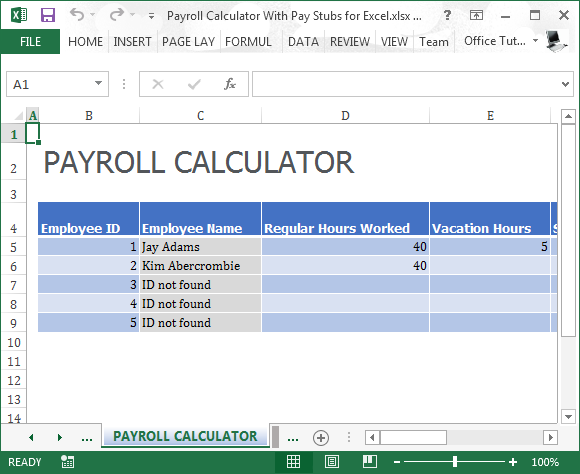

Payroll Calculator With Pay Stubs For Excel

Dutch Payroll Calculator To Check Net Salary Payingit International